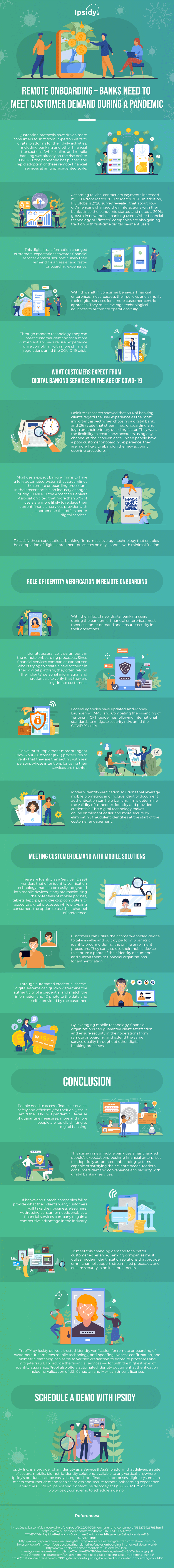

Many people started to prefer banking through digital platforms instead of in-person visits, thanks to the quarantine protocols put in place to keep the COVID-19 infection rate down. Both online and mobile banking solutions have been in use for years. Still, the pandemic accelerated the adoption of these solutions for widespread use.

The number of new mobile banking users and contactless payments increased amid the coronavirus pandemic. COVID-19 pushed for the adoption of remote platforms for many companies’ interactions with their customers. Many financial technology companies received multiple first-time digital payment users due to coronavirus.

Due to the restrictions, companies have to simplify their services and adjust their policies to attain a customer-centric approach. Companies must meet their customers’ demands for an easy, fast, and secure onboarding experience. Banking clients consider user experience and streamlined onboarding as vital aspects when selecting a digital bank they’ll trust.

Finance companies can invest in FIDO authentication solutions to be able to log in through device-based authentication. Doing so ensures that the bank will be able to see if the customers registering to them are legitimate or not. Financial service providers that do not have such solutions will likely lose customers as they do not feel secure and will opt to look for a better provider.

Customers look for both convenience and security in the remote onboarding process and banks must address this concern. Companies can accomplish this by using solutions that leverage mobile biometrics and identity document authentication through mobile devices and computers to expedite the digital processes.

Finance companies that give their customers options on which channel they prefer to access the bank are also ideal. Banking companies must use solutions that provide omnichannel support, simplified processes, secured online enrollments. Doing so provides customers with the peace of mind that they are transacting with a trustworthy bank. For more information, see Ipsidy’s infographic here.